Cryptocurrency

Because of the innovative hybrid consensus model, Solana enjoys interest from small-time traders and institutional traders alike. A significant focus for the Solana Foundation is to make decentralized finance accessible on a larger scale.< https://iowasportsguys.com/ /p>

The biggest Ethereum upgrade since The Merge, the Shanghai Upgrade will allow ETH stakers to unstake their ETH and withdraw ETH rewards from the Beacon Chain. During The Merge, the Ethereum proof-of-work chain merged with the proof-of-stake Beacon Chain. Instead of mining, validators stake 32 ETH to secure the network. However, stakers are unable to unstake and withdraw until the Shanghai Upgrade.

The two major changes are the introduction of the Merkelized Abstract Syntax Tree (MAST) and Schnorr Signature. MAST introduces a condition allowing the sender and recipient of a transaction to sign off on its settlement together. Schnorr Signature allows users to aggregate several signatures into one for a single transaction. This results in multi-signature transactions looking the same as regular transactions or more complex ones. By introducing this new address type, users can also save on transaction fees, as even complex transactions look like simple, single-signature ones.

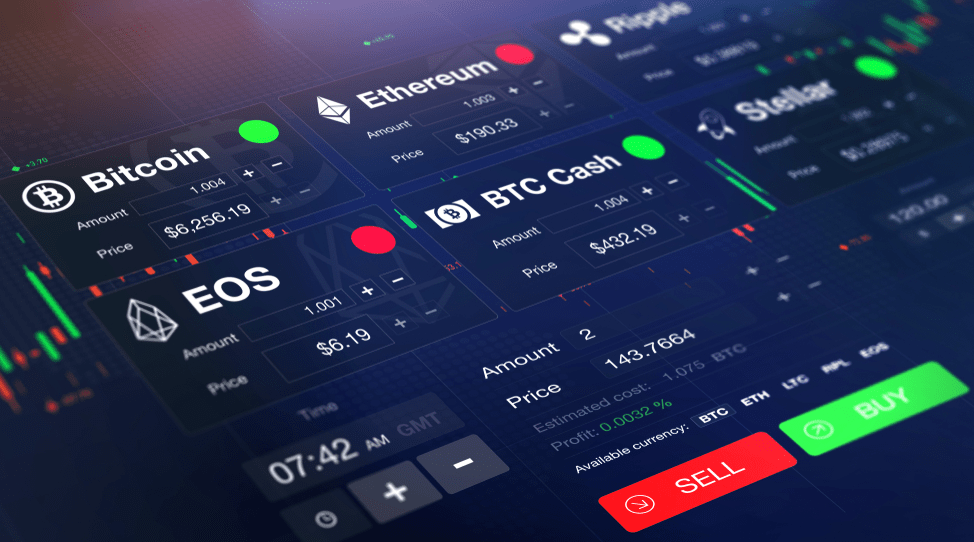

Cryptocurrency exchange

I was originally going to include these in the list, but the volume on even Uniswap was surprisingly low enough to not make the cut. The general structure for these is all the same, however. Connect your wallet to the app, and trade from there. You’ll have to pay network fees ontop of exchange fees though, which messes with the cost valuation a bit, and generally makes all of them significantly worse fees than the centralized exchanges.

You can use a range of payment methods to fund your account including Wire Transfer, Bank Drafts and Certified Cheques, or Interac E-Transfer. For withdrawing, you can make a direct bank deposit, wire transfer or crypto transfer, and card payments are also available for both. There is a separate OTC trading desk available for orders that exceed $40k.

It is very transparent with fees, and you can easily find pricing listed in the footer of their website. Since their fees offered are below the industry average, this is just another reason why BitBuy is a favorite option for many crypto traders in Canada. OTC trading is also available, and you can get an API if you need it. BitBuy is registered with FINTRAC and fully compliant, and they offer excellent customer service. For trading on the go, you can easily download their app for iOS and Android to make the experience even more convenient.

I’ve seen other people saying that both Coinbase and Binance are generally ok for small amounts, and I’m reasonably new to crypto and don’t have the cash to invest loads, so maybe Coinbase or Binance would be fine for me, but every time I read another post about the issues people have had, it makes me nervous!

Their coin variety listing isn’t stunning, but you can generally get most top 100 coins on Kraken. Passive income wise Kraken offers a double handful of coins for in-house staking at competitive rates without forced lockup times.

How does cryptocurrency work

Although cryptocurrencies are considered a form of money, the Internal Revenue Service (IRS) treats them as financial assets or property for tax purposes. And, as with most other investments, if you reap capital gains selling or trading cryptocurrencies, the government wants a piece of the profits. How exactly the IRS taxes digital assets—either as capital gains or ordinary income—depends on how long the taxpayer held the cryptocurrency and how they used it.

The access is shared between its users and any information shared is transparent, immediate, and “immutable”. Immutable means anything that blockchain records is there for good and cannot be modified or tampered with – even by an administrator.

Bitcoin was the first of the many cryptocurrencies that exist today. Following its introduction in 2009, developers began to create other variants of cryptocurrencies based on the technology powering the Bitcoin network. In most cases, the cryptocurrencies were designed to improve upon the standards set by Bitcoin. That is why other cryptocurrencies that came after bitcoin are collectively called “altcoins” from the phrase “alternatives to bitcoin.” Prominent examples are:

The first cryptocurrency introduced was Bitcoin, the most commonly traded one. Ethereum is the second most valuable cryptocurrency and can be used for complex transactions. Other more common cryptocurrencies, called altcoins, include Cardano, Solana, Dogecoin, and XRP.