A cash flow statement, also referred to as a statement of cash flows, shows the flow of funds to and from a business, organization, or individual. It is often prepared using the indirect method of accounting to calculate net cash flows. The statement is useful for analyzing business performance, making projections about future cash flows, influencing business planning, and informing important decisions. The term “cash” refers to both income and expenditures and may include investments and assets that you can easily convert to cash. To help you get started creating a cash flow statement or forecast, we’ve included a variety of customizable templates that you can download for free. Simply adjust your chosen template to fit your specific goals and the intended audience.

- You would monitor your credit card statement and allocate each transaction to specific expense categories.

- This Excel-adapted template is designed by Spreadsheet Page and is ideal for businesses looking to assess their financial future.

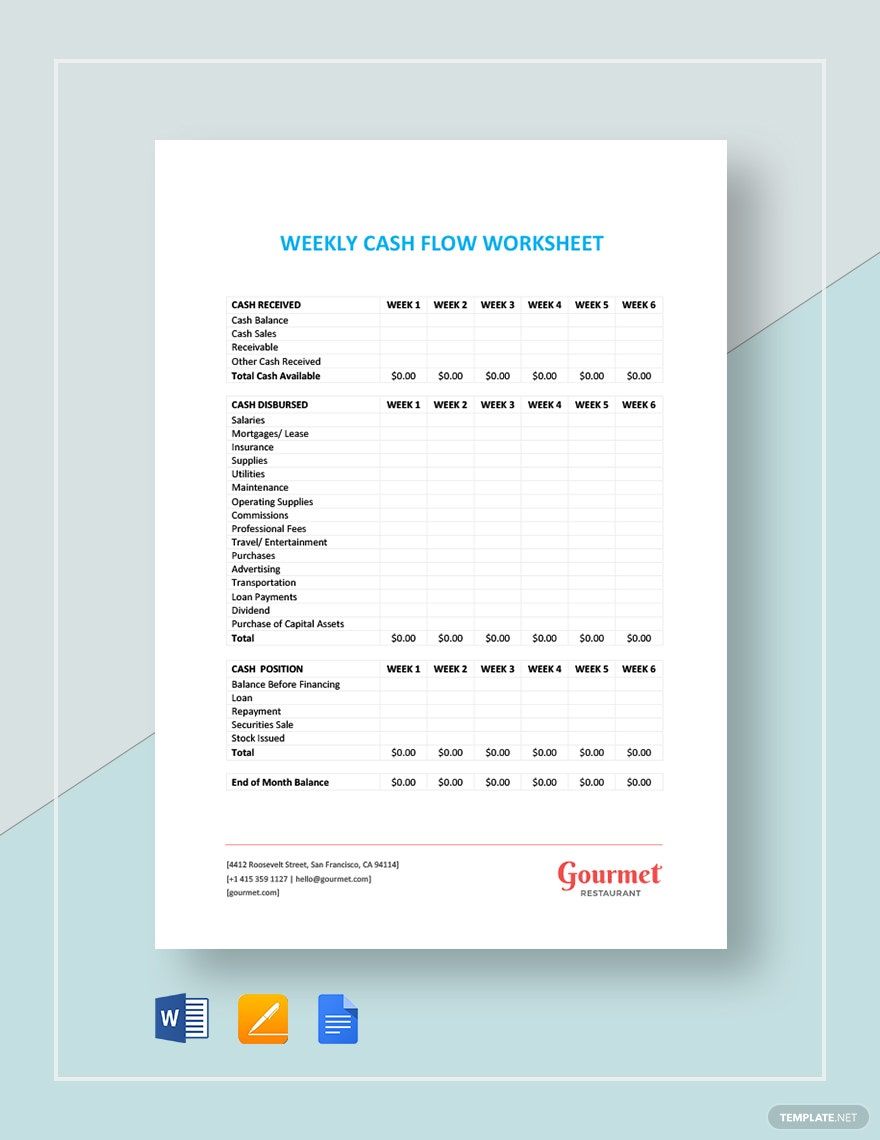

- Cash Flow Statement is a financial report to provide relevant information about the cash receipts and disbursements the company has in particular accounting period.

- While both methods provide the same end result, they have several important differences.

- You can think of your business’s cash flow like the waves of an ocean, with revenue washing in and payments for expenses flowing out.

- The template shows ending balances for specific accounts, as well as total amounts for the activity period and the overall difference.

Tiller Money Feeds

But many may not realize the value of seeing those financial results in graphical form. Company Cash Flow Planner spreadsheet is a spreadsheet to plan more detail about your company cash flow. It fits small business companies who manage their tight cash flow where their expenses rely upon… It’s important to always keep your objective in mind when choosing the right tools for your business.

Forecasting with a Cash Flow Statement

Well-managed companies plan for capital expenditures, which may include investments in machinery, equipment, and other long-term assets. A chain of restaurants, for example, must eventually replace ovens, refrigerators, and furniture. The cost of replacement should be included in the restaurant chain’s annual budget. Start by determining your operation’s net income and then converting the accrual net income into operating activity cash flows. Here’s an example of the direct cash flow statement for the sample company ABC Corporation.

Accounts Receivable Template

Incoming cash can include items like sales, loans received, new equity inflow, interest income, and other income. This template was designed by Live Flow, a trusted provider of financial management tools. At the end of each week, the template reporting partnership tax basis provides a summary of your cash balance, including the beginning and ending cash on hand. It also compares your ending cash balance to the minimum required cash balance, alerting you if your cash balance falls below the required threshold.

It starts with the opening balance and then provides space to record monthly cash inflow from various sources, such as contract payment claims, other receipts, and cash sales. In addition, this template provides an in-depth section for calculating Unlevered Beta and Relevered Beta based on the target debt/equity ratio, helping you assess risk more accurately. It also includes a Weighted Average Cost of Capital (WACC) calculation, providing a more comprehensive understanding of a company’s financial health. Vertex42 offers a ready-made cash flow worksheet, breaking down your finances into Operating, Investing and Financing activities. This spreadsheet can be accompanied by other Vertex42 financing templates, such as their income statement and profit loss projection templates.

As one of the 3 main financial statements, a cash flow statement is an essential tool for understanding a company’s financial health, assessing its liquidity, and confirming how much cash it has on hand. Obviously, having an accurate cash flow worksheet and resulting statement of cash flows is important for reasons other than compliance. Therefore, you want your worksheet to be insightful, straightforward, and capable of informing your company’s decision-makers. Keep a few best practices in mind to get the most from your cash flow worksheet. Manage your financial outlook with this personal cash flow forecast template.

The template concludes with the net increase or decrease in cash over the period, providing the beginning and ending cash balances. And thanks to color-coded sections for when your cash flow is positive or negative, you can easily spot trends and make necessary adjustments. A unique feature is the ability to visualize each category as a percentage of your total income or expense, enhancing your understanding of where your money is coming from and where it is going.

Built for use in the cloud-based Google Sheets platform, these templates come with pre-configured formulas to automatically calculate key metrics like net cash flow. A cash flow statement is a financial document typically used to understand the solvency of your business. When combined with other financial statements, it can give you a clear view of the financial health of your small business.