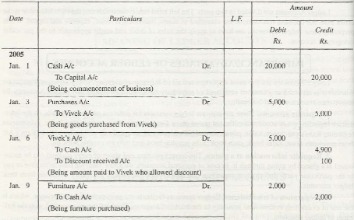

The purpose of a trial balance is to prove that the value of all the debit value balances equals the total of all the credit value balances. If the total of the debit column does not equal the total value of the credit column then this would show that there is an error in the nominal ledger accounts. This error must be found before a profit and loss statement and balance sheet can be produced. Whenever the basic accounting principles you need to know accounting concepts any adjustment is performed run trial balance and confirm if all the debit amount is equal to credit amount. Adjusted trial balance can be defined as “a listing of the general ledger accounts and their account balances at a point in time after the adjusting entries have been posted”. Adjusted trial balance includes the following accounting entries, which are not included in the trial balance.

If the debit and credit columns equal each other, it means the expenses equal the revenues. This would happen if a company broke even, meaning the company did not make or lose any money. If there is a difference between the two numbers, that difference is the amount of net income, or net loss, the company has earned. To get the numbers in these columns, you take the number in the trial balance column and add or subtract any number found in the adjustment column. There is no adjustment in the adjustment columns, so the Cash balance from the unadjusted balance column is transferred over to the adjusted trial balance columns at $24,800. Interest Receivable did not exist in the trial balance information, so the balance in the adjustment column of $140 is transferred over to the adjusted trial balance column.

While a trial balance can’t incontrovertibly prove that no errors exist anywhere in a business’s accounting system, it can point to inaccuracies and help to identify and correct errors in accounts in the general ledger. The trial balance shows the closing balances of all accounts in the general ledger at a point in time. So I know my adjusted trial balance is right because my debits and my credits are equal. It’s always going to come out the same as long as your debits and your credits are the same. In order to illustrate the process of going from the unadjusted trial balance to the adjusted trial balance, here we have an example of a company called XYZ Video Production Corp.

What is an adjusted trial balance?

Each nominal ledger account will hold either a debit balance or a credit balance. The debit balance values will be listed in the debit column of the trial balance and the credit value balance will be listed in the credit column. The trading profit and loss statement and balance sheet and other financial reports can then be produced using the ledger accounts listed on the same balance. Trial balances are used to prepare balance sheets and other financial statements and are an important document for auditors. A trial balance is done to check that the debit and credit column totals of the general ledger accounts match each other, which helps spot any accounting errors.

Review the annual report of Stora Enso which is an international company that utilizes the illustrated format in presenting its Balance Sheet, also called the Statement of Financial Position. If your cash is positive, it will go on the the debit side because that’s our normal side and that’s also the side that has the larger sum of the debits. We will also introduce a fast and secure global payment solution, Wise Business to will help cut the cost on your international payments and provide smart solutions to your financial transactions. If you’re using the wrong credit or debit card, it could be costing you serious money.

That is because they just started business this month and have no beginning retained earnings balance. Take a couple of minutes and fill in the income statement and balance sheet columns. The adjustments total of $2,415 balances in the debit and credit columns. An income statement shows the organization’s financial performance for a given period of time.

If the debit column were larger, this would mean the expenses were larger than revenues, leading to a net loss. You want to calculate the net income and enter it onto the worksheet. The $4,665 net income is found by taking the credit of $10,240 and subtracting the debit of $5,575. When entering net income, it should be written in the column with the lower total.

Adjusted Trial Balance to Income Statement

The statement of retained earnings (which is often a component of the statement of stockholders’ equity) shows how the equity (or value) of the organization has changed over a period of time. The statement of retained earnings is prepared second to determine the ending retained earnings balance for the period. The statement of retained earnings is prepared before the balance sheet because the ending retained earnings amount is a required element of the balance sheet. The following is the Statement of Retained Earnings for Printing Plus. In this method, both debit and credit side in the ledger is totalled; then, they are reported in the trial balance in specific columns. The sum of the debit column and the credit column should be equivalent.

Frameworks for estimating causal effects in observational settings … – BMC Medical Research Methodology

Frameworks for estimating causal effects in observational settings ….

Posted: Mon, 22 May 2023 07:00:00 GMT [source]

A trial balance is a summarized worksheet which includes all ledger balances as at a particular point in time. All the debit balances will be recorded in one column with all the credit balances in another. The main objective of preparing a trial balance is to detect the mathematical accuracy of the ledger balances. Yes, the adjusted trial balance must balance the debits with the credits for the accounting period being reported. All trial balance reports, whether adjusted or unadjusted, must match debits to credits. This ensures that the entries made into the accounting system are in proper alignment with the double-entry bookkeeping system.

S Corp vs. C Corp: What are the Differences and Benefits?

In addition, an adjusted trial balance is used to prepare closing entries. This is called a “closing entry.” If the company earned a profit, the retained earnings account will be increased. If the company experienced a loss, the retained earnings account will be reduced. The resulting opening balance for the new accounting period will still have columns of equal sum totals. Its purpose is to test the equality between debits and credits after adjusting entries are made, i.e., after account balances have been updated.

- The 10-column worksheet is an all-in-one spreadsheet showing the transition of account information from the trial balance through the financial statements.

- After adjustments have been made to correct any errors, it’s called an adjusted trial balance and is used to prepare other financial statements.

- They are an important part of the accrual basis method as most adjusting entries are accruals.

- There are number of reasons the company needs to make the adjustment to the trial balance and mostly it happens when the company closes the book or financial statements at the end of the period/year.

- It makes certain that the adjustments work with the accounting cycle.

After the adjusted trial balance is prepared the financial balances are used to create the financial statements. In double-entry accounting, a credit to any account must be offset by a debit to another account. If your general ledger is accurate, the debit balance will equal the credit balance. Companies initially record their business transactions in bookkeeping accounts within the general ledger.

Difference Between Coronavirus and Cold Symptoms

If both sides get tallied, that means the books are arithmetically accurate and are free from all the errors. The essence of the adjusted trial balance is the year-end adjusting entries. An adjusted trial balance is a trial balance to which the adjusting entries have been added. The adjusted trial balance is generally completed separately from the original trial balance as a check to make certain the adjusting entries made comply with the accounting equation.

It includes at least three columns, including the account name, debit, and credit side. Each item in the trial balance also consists of its balance on its relative debit or credit column. Usually, it enlists balances related to assets, liabilities, equity, income, and expenses.

This is usually the last step in the accounting cycle before the preparation of financial statements. Service Revenue had a $9,500 credit balance in the trial balance column, and a $600 credit balance in the Adjustments column. To get the $10,100 credit balance in the adjusted trial balance column requires adding together both credits in the trial balance and adjustment columns (9,500 + 600).

To prepare the financial statements, a company will look at the adjusted trial balance for account information. From this information, the company will begin constructing each of the statements, beginning with the income statement. The statement of retained earnings will include beginning retained earnings, any net income (loss) (found on the income statement), and dividends. The balance sheet is going to include assets, contra assets, liabilities, and stockholder equity accounts, including ending retained earnings and common stock. The unadjusted trial balance is a listing of the company’s accounts and their balances after all the transactions of an accounting period have been recorded.

Importance of Trial Balance (Explained)

The adjusted trial balance also helps verify the total of the debit and credit balances in the general ledger. By balancing these items, companies can ensure that the accounting entries within the accounting system are complete. Similarly, the adjusting trial balance also helps provide a summary of all general ledger accounts before reporting them in the financial statements. A trial balance is a report of all accounting transactions entered throughout the accounting period. Its main purpose is to ensure that all debits equal all credits for the transactions entered during that time. The adjusted trial balance is a report of all transactions entered during an accounting period after the adjusting entries have been completed.

The unadjusted trial balance is prepared on the fly, before adjusting journal entries are completed. It is a record of day-to-day transactions and can be used to balance a ledger by adjusting entries. An adjusted trial balance is a listing of the ending balances in all accounts after adjusting entries have been prepared. As we know, final accounts are prepared at the end of an accounting period, by that time ledger balances also change due to day-to-day business transactions.